iBank 2.1.7

Company: IGG Software, LLC

Price: US$ 39.99

http://www.iggsoftware.com/ibank

Money makes the world go round, no doubt about it. Knowing how much or how little you have, allows you to make appropriate plans and avoid costly overdrafts from your bank.

Have you ever gotten your credit card bill, looked at the total, and just knew the bank got it wrong? That is, you knew they got it wrong, until you checked the bill carefully and realized it they are right after all. To be honest I can’t really imagine this anymore, but I know it happens all the time to other people.

My answer to the problem is personal financial software. For me it is “can’t do without†software, the type you install the second you get your computer. They type of software you actually spend a good amount of time in every week, but also the type that is worth every penny and every minute you spend.

In the windows world I first used Quicken and later I changed to Microsoft Money. To be fair, I didn’t hand pick, it usually came with my computer and both products had their merits. When I switched to Mac OS, I had the hardest time to find an application that would do the trick – I finally found iBank and I am truly quite happy with this solution.

The basics

The most basic task of personal financial software is to give you a single space to record all incoming and outgoing payments. You can assign each transaction a category, to ultimately allow you some statistical analysis on it all. Good software will let you setup budgets, allowing you to see whether you spent too much on iTunes songs this month, or whether you’ve been really good with that gadget addiction of yours.

You will have the opportunity to schedule transactions, like your monthly salary, or expenses for rent and electricity and of course anything else that reoccurs. All in all, when you have spend some time setting everything up, you have a single work space telling you how you are doing financially. Ultimately, while you might end up spending a little bit of time on this software every week, it will safe you lots of time when the bank statements come around and when your tax return is due.

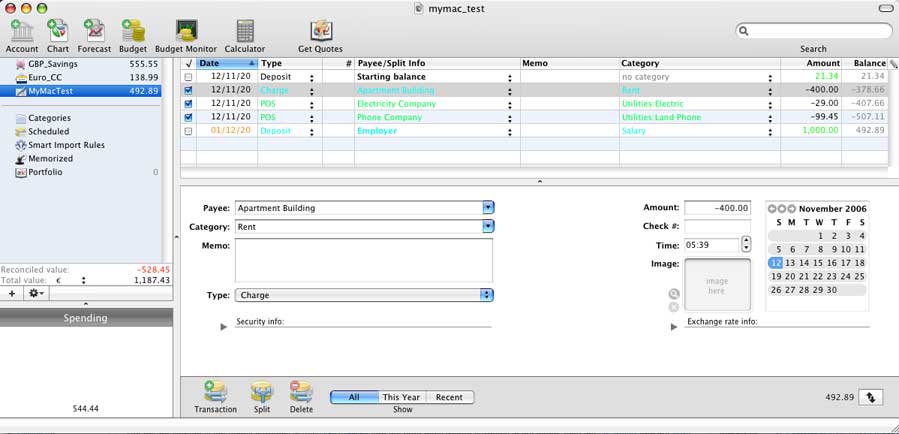

iBank is a smart little application, which is rather powerful. It is very simple to setup and for me most important of all, it supports multiple currencies. Now for most of you this might not be important, but to me it made the buying decision.

Setup & Getting Started

Setup couldn’t be easier, drag and drop the application, start iBank and follow the setup assistant. If you already used other type of personal financial software, this is where you can import your previous files. During setup you are also going to be asked, what type of categories you’d like to setup up “home†or “businessâ€, or possibly both. These preset categories, will cover most of what you will need and you can add to them any time.

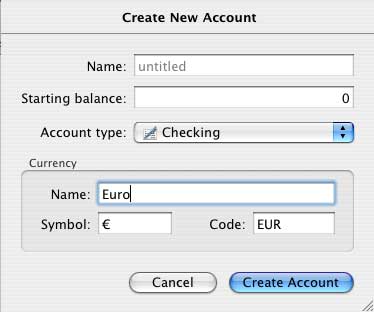

After that you go in an add your accounts. Make sure to you have your most recent bank statement ready, it will make things a little easier. Most basically, you click on Account > New Account and a little window asks you for a name, a starting balance, offer you to select an account type (Checking, Savings, Credit Card, Investment, Asset, Liability, Cash) and the currency, you’d like to use.

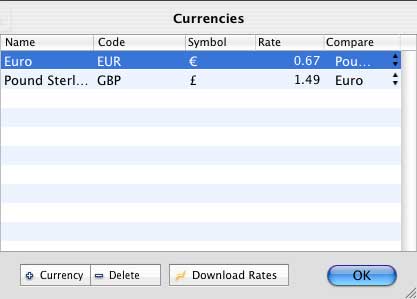

If you are going to use multiple currencies, your next visit will be to the Account menu again. Click Show Currencies and make sure you set the compare to appropriately, then download exchange rates. This will make sure that your total net worth is reported properly later on.

iBank does nicely show your networth in one currency, while allowing you to work in the native currency of the account. Something I value and that made me choose iBank over Quicken for Mac. When I looked at Quicken, it didn’t do multiple currencies, not sure whether it does now.

There is however one annoyance in here, rather than letting you select currency names from a drop down list and have the symbol and ISO code (e.g. € = EUR; $ = USD, etc.) show up automatically, you’ve got to enter it manually. Not a big problem, but a nice area for improvement.

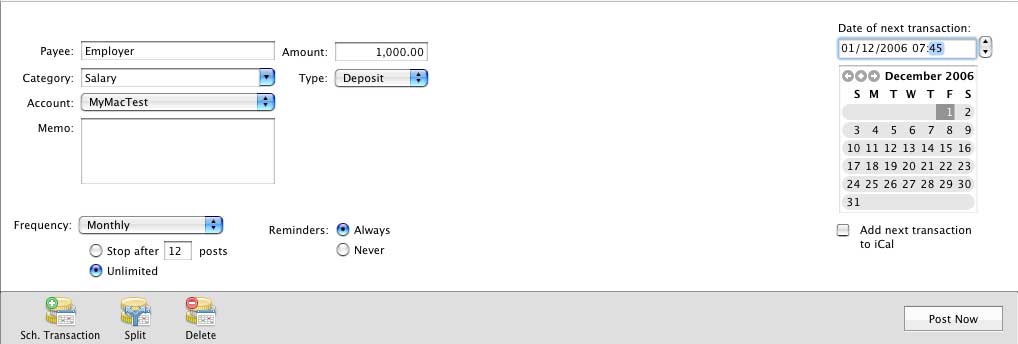

Once your basic setup is complete it will be useful to click on “Scheduled†and make sure to enter reoccurring transactions. Like paying rent, or getting paid from work. This will ensure you don’t have to enter them manually all the time, but also to allow you to plan appropriately. Notice the button that allows you to add the date to iCal for reminders.

Here in Germany your boss will pay you by direct deposit, and most of your bills come out of your bank account by direct debit. This is very convenient, since it means that I do not even own a check book, but at the same time it makes planning even more important. I need to make sure I have plenty of money to pay rent, because it will come out of my account on the first of the month, no matter what.

Your next step might be to setup budgets – allow yourself to spend x amount of money on groceries, clothes, and so on in a month. Ultimately there will be a nice bar chart telling you, whether you stick to your budget or not. Quite useful, if money is tight – and let’s face it, it is with most of us.

One last setup item to go through is setting up categories, making sure you can track expenses in the right category and in a way you would like to keep track of them. But don’t worry – if you can’t be bothered right now, you can come back later to set it up, or even set them up on the fly, while you enter a transaction.

It really couldn’t be easier, you are going to be asked to fill in the basic information, you would have put on a check. You enter the payee, the amount you paid, the date and a category. Simply select from the drop down box, or if nothing appropriate is there, type a new category. iBank will try to recommend an appropriate category based on what you type and if you haven’t got one, it will simply add it.

This is also, where it gets a bit annoying at times, as you could quite easily end up with too many categories. One months going to the cinema might be recorded as Entertainment: Movies, the next month you might have recorded it as Cinema, and a month later as yet something else. Be careful, the fewer categories you have, the easier it will be to report and make sense of the report. In other words, try to be consistent and make your selections from the drop down box. I’d wished a little notification box that says “you are about to add a new category, are you sure?â€. But other than that, things are simple enough.

The only other complaint I have, and it might not be iBank’s fault, but my computer setup, is with decimal points. I use the English version, Mac OS X (International English), with a German keyboard. Over here we use a comma where Americans and English use a dot and vice versa, i.e. I am used to type 0,99 for the cost of an iTunes song. Unfortunately iBank misinterprets this entry and changes it to 99.00 – not quite the same. I’ve got used to enter 0.99 now. I am fairly certain it is my awkward setup.

A useful feature here, is that once you used iBank for a while, it starts to help you fill in the form. If you go to Walmart every week and record transactions as Groceries, after a while, as soon as you type in Walmart it will fill in the other fields, including your last transaction value and all you’ve got to do is change the value. Useful.

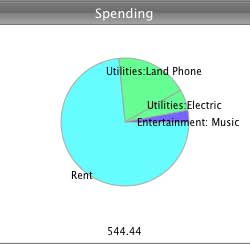

The last bits I want to mention is the basic analysis that will pop up for you. There is a pie chart showing you what you “wasted†your money on in this month. This can be quite useful and I glance at it quite frequently.

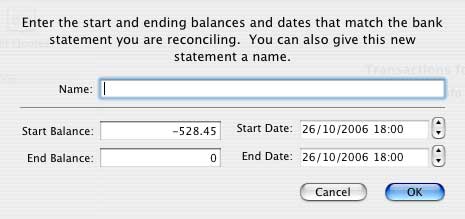

Also, there is a nice reconcile accounts feature. If you’ve been good and entered your expenses, you click your account and then go to Accounts and select Reconcile with Bank Statements. It will show all the transactions that fall within your statement and allows you to make sure it all adds up and is correct. Missing a transaction, simply enter it.

Conclusion

Personal Financial Software isn’t right for everyone, but if you want to stay on top of expenses, especially when money is tight it is a good investment. I have a lot of expenses for work and iBank helps me keep track of them.

The solution works really well, the developers bring out updates regularly and there aren’t any major problems that would put me off. Indeed it works so well that I can’t seem to do without it.

MyMac.com Rating: a strong 4 out of 5

System Requirement:

Mac OS X 10.4.3 or higher; Screen resolution of at least 1028×640

Universal Binary

Available Languages: American English, British English, French, German, Italian

Leave a Reply

You must be logged in to post a comment.